As the Deadline Nears…Seven things to watch out for in 5 AMLD

The European Union’s Fifth Anti Money Laundering Directive (5 AMLD) must be implemented in national law by 10 January 2020. The Anti Money...

Money Laundering in Russia Case Study: Space Industry

The Office of the Investigative Committee of Russia (IC) in Moscow has completed an investigation of the theft of more than a billion rubles (>$14...

How vulnerable are western banks to state-sponsored cybercrime?

The world breathed a sigh of relieve when Donald Trump de-escalated the tensions between the United States and Iran, which started when an American...

Artificial intelligence: Reducing the AML Compliance Burden

How did we get here? Since 9/11 financial institutions have made enormous investments in their anti-money laundering compliance programmes, but they...

Panel Discussion – Blockchain & KYC Hype to Real Applications

It was a pleasure for me discussing - Blockchain & KYC Hype to Real Applications - with the other panel experts: Roman Stammes, Yana Afanasieva,...

Money Laundering in a Digital Age – The Perfect Storm

The new Black With the rapid advancement of mobile technologies, the internet is now accessible from any- and everywhere. Open banking...

Sanction Screening the Intensive Care Patient…Innovation the Cure!

However, minor the task of sanction screening or name filtering sounds it contributes to a significant amount of false positives and is a time...

Demystifying blockchain: what it means for KYC

Hardly a day goes by without a news item concerning the use of cryptocurrencies for money laundering. In June the Financial Action Task Force (FATF)...

Trade-based Money Laundering – and How to Combat It.

With international trade valued at approximately US$ 16 trillion per annum, it provides ample scope for money laundering. According to the...

Instant payments: Enormous Potential versus Financial Crime Risks

The world of banking continues to evolve at a breathtaking pace and is becoming ever more competitive. Once a new technology has come...

Combating Money Laundering with Artificial Intelligence: Game changer or Hype

The cost of money laundering and other forms of financial crime are critical to a bank’s future. Germany’s troubled Deutsche Bank faces fines, legal...

As Cryptocurrencies become Mainstream, they must embrace KYC Compliance

Maybe I am just getting old, but it came as a shock that Bitcoin has now been around for a decade. Yes, it was launched in January 2009. Early in...

Brexit Countdown: The impact on AML!

The European Commission’s fifth Anti-Money Laundering Directive entered into force on 9 July 2018 and Member States have until 10 January 2020 to...

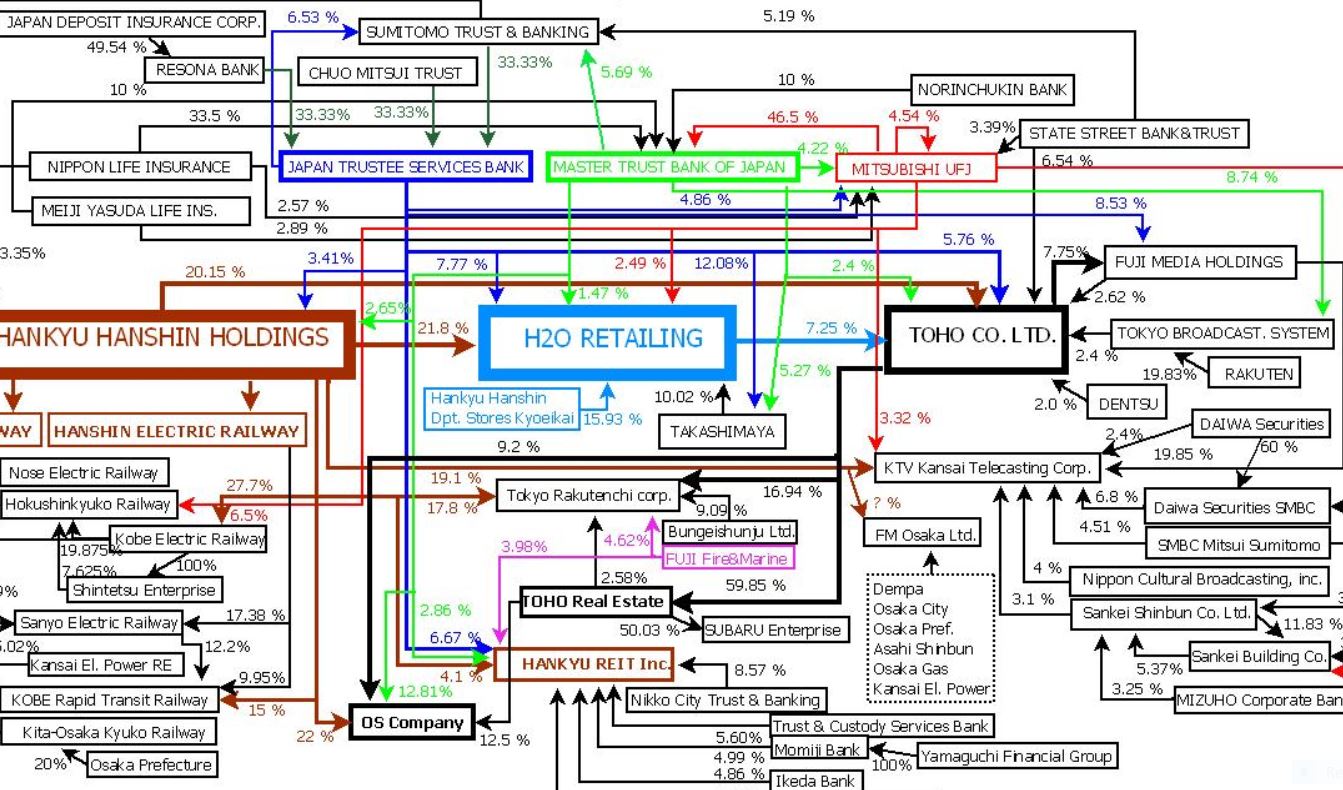

The Global Laundromat

Transparency campaigners dismayed at clean bill of health for UK government On Friday, 7 December the Financial Action Task Force (FATF), a G7...

Utility and Security Tokens: A Growing Case for Crypto Self-Regulation

The early 21st century might very well go down in the annals of history as the gold rush of the modern age. Utility and security tokens are emerging...

Broadening the scope of AML

Preparing for the European Union Sixth Money Laundering Directive Anti-money laundering (AML) law is constantly evolving. And necessarily so, given...

Bitcoin vs. Fiat, Time for the New Wine

Bitcoin vs. fiat is more than an academic argument. It’s a fierce battle between a manipulated monetary regime and one of honest weights and...

The Impact of Upcoming Cryptocurrencies on the Financial Industry

Upcoming Cryptocurrencies are Causing a Financial Evolution In 2009, Satoshi Nakamoto created Bitcoin partly in response to the 2008...

How Blockchain Financial Services Will Transform the Global Economy

Blockchain technology is transforming what it means to banks in major ways. People from all over the world are learning about the advantages...

Cryptojacking, Hacks, and Scams: N.Korea Is Ramping up Cyber Attacks

The North Korean government is currently facing a flurry of accusations related to cryptocurrency hacks, cryptojacking attacks, and money...

Blockchain and the Battle Against Corruption & Fraud

Corruption, embezzlement, fraud, these are all characteristics which exist everywhere. It is regrettably the way human nature functions, whether we...

Are we taking Anti-Money Laundering for granted?

Basel Institute reveals slow progress in AML Earlier this month the Basel Institute on Governance announced the release of the Basel Centre for...

How Exchanges Are Using KYC Laws to Keep Your Crypto

Bitcoin is the world’s first successful attempt at creating a decentralized economic structure. At its core, is a belief that individuals deserve a...

On the Frontline: How Blockchain Forensics Fight Crypto Crimes

One of the first things that any crypto noob learns about Bitcoin is that it isn’t anonymous. The takedown of dark web marketplace Silk...

Blockchain Remittance: The Future of International Money

Blockchain remittance firms are experiencing record growth thanks to an increase in global migration. As populations continue to migrate, the need...

Blockchain Fraud: New Policies and Technologies to Stop Crypto Criminals

Blockchain fraud continues to be a massive problem that has hindered the possibilities of new user adoption. Crypto criminals primarily participate...

What Is Cryptojacking? Protect Yourself from This Year’s Biggest Cyber Crime.

It sounds like an adrenaline-packed adventure sport. You can almost imagine telling your friends you went cryptojacking down a volcano whilst on...

Privacy Coins – What are they, how do they work and why are they needed

Privacy coins implement functionality to hide your identity when making transactions. They also can...

Why Is Cryptocurrency Associated with Criminal Activity?

Despite countless examples to the contrary, many people still toss cryptocurrency and criminal activity into the same bucket. But is this born out...

Dark Web: US Authorities Arrest 35 Individuals Engaged in Illicit Cryptocurrency Activities

Law enforcement agencies in the U.S. struck Dark Web vendors and confiscated illegal items worth over $23.6 million, according to a U.S. Department...

Russia Potentially Helped Venezuela Launch Petro to Dodge U.S. Sanctions

On March 19, 2018 Donald Trump issued a executive order banning Venezuelan President Nicolás Maduro’s...

Money laundering in Russia and what we know!

Money laundering in Russia has its own characteristics. In the normal world money laundering is the transformation of "illicit money" into "clean...

Europol Busts Cybercrime King Pin Responsible for Laundering €1bln with Cryptocurrency

€1bln in Stolen Bank Funds “Hidden” with Crypto A recent cybercrime bust has given civil authorities more fodder to feed the argument that popular...

Cryptocurrency – Enabler of Crime or Fake News?

Cryptocurrencies are in their embryonic stage and individuals will exploit this period to profit from them for both good and bad. But, that doesn’t...

Do We Really Need Cryptocurrency? – A Modern Exploration of Money

A number of leading businessmen and economists have questioned the need for cryptographic currencies over traditional fiat (paper) ones. Bitcoin,...

How is Blockchain Being Applied to Cybersecurity Right Now?

We’re getting pretty used to hearing about cool new projects using blockchain. From online marketplaces to green energy; every man, woman, and their...

CRYPTOCURRENCIES IN AFRICA: THE GHANAIAN SITUATION

Cryptocurrency use is still in its infancy. Cryptocurrencies have been in use around the world, especially in the developed world (Africa) ever...

Crypto Crimes: ICO Scams, Robbery, and Money Laundering

The rising popularity of cryptocurrency and blockchain technology has brought many benefits to the world; however, this hasn’t come without a few...

The Cryptoexchange Poloniex implements new KYC rules

Over the weekend, Circle-owned Poloniex exchange froze a slew of user accounts in the midst of implementing a new know your customer (KYC)...

Cryptocurrency: Currency of Choice for Money Laundering and Terrorist Financing?

Cryptocurrency is only used in on Darknet and by Criminals! I don’t know a topic that is more misunderstood...

Follow the Money – Has Cryptocurrency Rendered this Adage Useless?

Cybercriminals predate the use of cryptocurrency Indeed, editorial stories like this one “Bitcoin Gains Value...

Customer-Centric Risk and Compliance

Disruption in the Financial Industry Technology has always had the ability to generate hype and excitement. In...

Should cyber and anti-money laundering units remain distinct entities?

Why the Carbanak Campaign and the Bangladesh Bank attacks are a wake-up call for every AML compliance program. Someone once asked me how long will...

Women are being traded as slaves on WhatsApp – here’s how the UN can act

The members of the United Nations Security Council hear terrible stories from conflict zones with alarming frequency. So it takes a truly horrific...

Tighter U.S. CDD requirements and what they mean for foreign banks…Deadline to Comply is MAY 2018

Tighter U.S. CDD requirements and what they mean for foreign banks…Deadline to Comply is MAY 2018 In the aftermath of the Panama Papers controversy,...

The Sandbox where Innovation and Regulation can Play without Anyone Getting Hurt.

The internet has opened the door to purchase anything, I do mean anything, from any part of the world. These items can be paid for instantly through...

Judge rules Bitcoin is not money…Does this ruling open Pandora’s Box for Money Launders?

A recently-issued ruling by a South Florida judge that Bitcoin is not money, but equates more to property, has law enforcement puzzled, they feel...

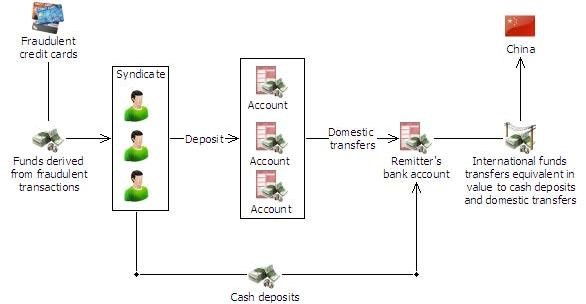

Ten thousand fake credit cards seized from money laundering syndicate

A suspicious matter report (SMR) was the catalyst for a law enforcement operation which resulted in the arrest of three foreign nationals. The...

European Commission strengthens rules to tackle terrorism financing, tax avoidance and money laundering

On 5 July 2016, the European Commission (the “Commission”), adopted proposals to further reinforce EU rules on anti-money laundering, counter...

“FinCEN Finalizes Customer Due Diligence Rule Amid Other Actions to Enhance Financial Transparency”

"In the wake of the Panama Papers controversy, the U.S. government has taken major steps this month to promote financial transparency. First, the...