Cryptocurrency is only used in on Darknet and by Criminals!

I don’t know a topic that is more misunderstood than cryptocurrency. US regulators unofficially coined the umbrella term “virtual currency” to denote bitcoin and other blockchain-based cryptocurrencies. In countless articles, cryptocurrency, virtual, and digital currency are used interchangeably. For example, the Bangkok Post referred to “virtual currencies including the bitcoin”, while the Toronto Star described the collapse of a bitcoin exchange after hackers stole its “digital currency”. On bitcoinmagazine.com an author illustrated the difference between cryptocurrencies and digital currencies while referring to their use in online virtual economies. In reality, one size doesn’t fit all. Therefore, to understand cryptocurrency you need to first understand what it is and what it isn’t.One Size Doesn’t Fit All

For many, the confusion starts right away with the coining (no pun intended!) of umbrella terms such as digital and virtual currencies to include cryptocurrencies. Crypto, digital, traditional and virtual currencies have different attributes and traits and knowing them is necessary for the assessment of the individual risk that each pose as a strategic vehicle for money laundering and terrorist financing.Fiat currency

Fiat currency is also known as traditional currency issued, monitored and regulated by a centralized government agency. In fact, 8 percent of the world’s money is represented by physical notes. They are used to purchase goods and services. Fiat currencies, in most cases, have no underlying assets of value such as gold or silver. Therefore, their material worth is only as good as the faith of their issuing government.Digital Currency

Digital currencies such as Visa, AMEX, MasterCard, Bank Cards, and PayPal are a digital form of fiat currency. Also, connected to a user’s bank account and transactions are constantly monitored for known money laundering and fraud typologies. Digital currencies in the form of credit cards issued to consumers, giving them an instant form of credit. Digital currencies operate within an enormous ecosystem of banks, consumers, merchants, and the card companies themselves. Therefore, it’s hard to imagine how digital currency would offer an organized crime syndicate a strategic advantage as a vehicle to launder large sums of money. Of course, terrorist financing is another game altogether. Digital currency in the form of a pre-paid gift card is an adequate vehicle to move smaller amounts of money while flying under the radar.Virtual currency

A form of currency or game tokens, issued by a centralized entity (not to be confused with a centralized government agency). Circulated within the boundary of a virtual economy (e.g. Second Life, World of Warcraft, EVE Online, etc.) as a game currency. Also, the top virtual platforms, which I checked, will only allow established payment methods (e.g. bank accounts, credit cards (aka digital currency), Skrill, etc.) when purchasing their virtual currencies. Again to set up these payment methods the owners or entity should have gone through the KYC. It’s questionable if these virtual platforms offer the necessary liquidity as well as the economic stability to be strategically interesting as a vehicle for laundering large sums of money. Therefore, it seems that these platforms offer more value for someone acting as a lone wolf trying to transfer or launder smaller amounts of money.Cryptocurrency

Peer-to-Peer electronic cash systems allow payments to be directly sent from one party to another without a financial institution. A fundamental element of any cryptocurrency system is their Blockchain also known as a distributed public ledger, which is shared among network participants. In the absence of a central authority, miners and maintainers are incentivized with native tokens for their support in operating the network. Cryptocurrency can also be exchanged for services and goods similar to digital currencies, but with a substantially smaller merchant clientele base than digital currencies. To date, Bitcoin with 72 percent (as of December 2017) market share is by far the most popular cryptocurrency. Furthermore, any serious exchange or wallet service will conduct a thorough Know Your Customer (KYC) on every new account as part of their onboarding process. That means linking personal identity to your wallet and to your bank account. Accordingly, a serious exchange or e-wallet will only transfer funds for a cash withdrawal to a connected bank account.There is the Grey Zone

First, it is debatable if cryptocurrency is a currency at all! There are an estimated 5.8 million unique active users of cryptocurrencies (Cambridge Centre for Alternative Finance). Many of which are operating in a grey zone when it comes to rules and regulation around cryptocurrency or a lack of them. In the USA, there have been controversial cases where presiding judges of similar court cases involving cryptocurrency came to contrasting conclusions and rulings. For example, in the case of Michell Espinoza Judge Pooler’s threw out felony charges. At the time, Michell Espinoza had an account on a website, localBitcoins.com, where he allegedly traded Bitcoin for a profit. The defendant accused of transmitting (as a money services business) and laundering $1,500 worth of Bitcoins by Miami Beach Police and the U.S. Secret Service, while acting undercover. On the charges of engaging in a money services business, the judge issued the statement that “attempting to fit the sale of Bitcoin into a statutory scheme regulating money services businesses is like fitting a square peg in a round hole.” Bitcoin is not, she noted “backed by anything” and is “certainly not tangible wealth and cannot be hidden under a mattress like cash and gold bars.” To the charges of money laundering, Judge Pooler clarified that money laundering is “commonly understood to be the method by which proceeds from illicit activity (“dirty money”) becomes legitimized.” The judge also mentioned that Florida law — states that a person can only be charged with money laundering if they engage in a financial transaction that will “promote” illegal activity — is way too vague to apply to Bitcoin. “Judge Pooler there was no financial transaction because Bitcoin is not money”. Judge Pooler also noted that while the court is not an expert in economics; however, it is clear, even to someone with limited knowledge in the area, that Bitcoin has a long way to go before it is the equivalent of money. In a similar case to that of Michell Espinoza, Judge Nathan made precisely the opposite ruling to Judge Pooler. Anthony Murgio, an operator at Coin.mx, indicted in 2016 for working without a money transmission license. He was charged with money laundering and failure to file suspicious activity reports. Murgio’s council has been fighting to have the money laundering charges dismissed, arguing that Bitcoin is not a legal currency. “Judge Nathan rejected arguments to dismiss the money laundering charges, claiming that Bitcoin explicitly qualifies as currency”. She defended her decision by saying Bitcoins are funds within the plain meaning of that term. Bitcoins can be accepted as a payment for goods and services or bought directly from an exchange with a bank account. Therefore, they function as pecuniary resources and used as a medium of exchange and a means of payment. Clearly, governments were caught off guard by the quick adoption of cryptocurrency and now everyone is grappling with fundamental issues like what it is, how to tax and regulate it.Cryptocurrency an Enabler of Crime?

Editorial stories like this one “Bitcoin Gains Value Due to Criminal Use [Only], writes a Forbes Columnist” has influenced us into believing that cryptocurrency is only used by organized crime and terrorist on the darknet. Because it provides them with complete anonymity. Subsequently, another article gave the impression that ISIS and organized crime syndicates were using a shadow banking system (aka darknet) and cryptocurrencies to systematically launder tens of millions, if not, hundreds of millions of dollars on a regular basis, while law enforcement watched helplessly. Overall, the conversations concerning cryptocurrency role in enabling cybercrime, money laundering, and terrorist financing are riddled with misconceptions. Of course, criminals are resourceful and will always use whatever means are available that give them the greatest chance to succeed, which according to the UK’s national risk assessment (NRA) of money laundering and terrorist financing that continues to be High-end and cash-based money laundering. Key findings of the 2017 UK’s national risk assessment (NRA) of money laundering and terrorist financing comes amidst the most significant period for the UK’s anti-money laundering (AML) and counter-terrorist financing (CTF) regime for over a decade the assessment shows that: • High-end money laundering and cash-based money laundering remain the greatest areas of money laundering risk to the UK. New typologies continue to emerge, including risks of money laundering through capital markets and increasing exploitation of technology, though these appear less prevalent than longstanding and well-known risks. • The distinctions between typologies are becoming increasingly blurred. Law enforcement agencies see criminal funds progressing from lower level laundering before accumulating into larger sums to be sent overseas through more sophisticated methods, including retail banking and money transmission services. Maybe, law enforcement panicked in the beginning, but they have adapted and the blockchain technology is not only a digital time-stamp but a digital witness!

For those, individuals willing to go the extra mile to cover their tracks. The market is saturated with unlawful businesses offering alternative entry points and mixing services to help users improve the anonymity of their cryptocurrency transactions. Likewise, there are cryptocurrencies like Monero (XMR), DASH (DASH), and ZCash (ZEC) that offer users an extra layer of anonymity by applying zero-knowledge proof or a built-in mixing process as is the case with DASH. Granted, the options for concealing one’s identity are endless, and as a result, it makes life harder for law enforcement to follow or tie a transaction to an individual, but not impossible!

Before deciding to use an alternative entry point or a coin with zero-knowledge proof to hide one’s identity here are some things to consider:

- Cyber attacks and insider fraud are not uncommon events at legitimate cryptocurrency businesses. I can’t imagine that an unlawful business would be a better custodian for someone trying to hide the source of their money.

- A majority of businesses operating unlawfully are already on law enforcements’ radar and a subpoena can be issued at any time.

- A business offering unlawful services can also be a setup by law enforcement.

- Mixing is more vulnerable to Sybil attacks.

- Mixing is not immune to forensic technology so there is always a real chance that investigators can link the coins back to the original address.

- Mixing needs at least two people, therefore you are helping someone to launder their money

- What if, after mixing, you receive coins that were involved in a crime and law enforcement traced them to you. Likely outcome these coins will be confiscated and you might require expensive legal counseling to avoid criminal charges.

- Let’s not take our eyes off the main players in the industry. Miners confirm valid transactions. Also, 50 percent of the hashpower is controlled by a handful of miners. Government agencies can always apply pressure to these miners as witnessed in China.

- Coins that claim to offer total privacy all have their own nuances and if not used accordingly can jeopardize any chance of anonymity. For example, take Monero it offers users full anonymity as long as it is used on its blockchain. Also, many are relatively new ICOs, therefore, the bugs haven’t yet been identified.

- It’s only a matter of time before the crypto-industry is regulated and it’s probably safe to say that holders of coins offering total anonymity will be penalized.

- Unfortunately, for bad actors, the flow of sending and receiving data through these cryptocurrency networks are not well-coordinated events. Therefore, anyone monitoring a network will be able to immediately recognize when a transaction is sent out and map it to that IP address as the owner of that cryptocurrency. Also, when a massive number of transactions are sent from a single source, it’s only a matter of time before the addresses are unwound and mapped to their proper IP addresses.

Under Attack

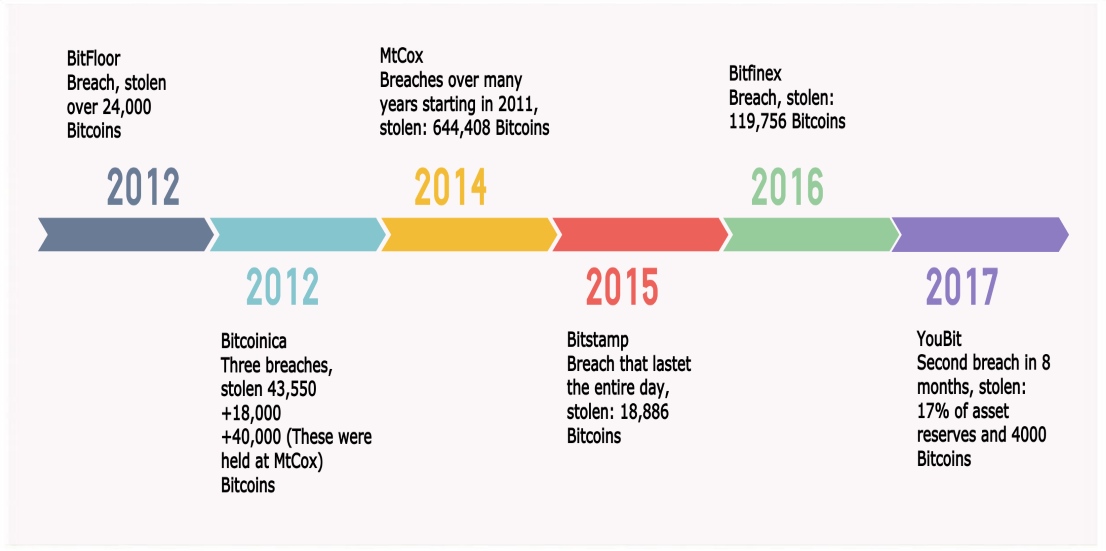

However, such alternatives could leave holders of cryptocurrency with uncalculated risk due to the potential of cyber attacks, theft, and fraud. According to a report by Imperva Incapsula titled “Q3 2017 Global DDoS Threat Landscape.” Digital currency operators and Bitcoin exchanges are already the most common targets of distributed denial of service (DDoS) attacks. Also, the report cited that three out of four Bitcoin sites was a victim of DDoS attacks in the third quarter of 2017 alone. Since 2011 to December 2017, there have been at least 30 heists at cryptocurrency exchanges. No one would argue that Bitcoin holders have suffered the most, in fact, It is estimated that more than 900,000 Bitcoins have been stolen with a potential value of $ 6.3 billion as of Dec 2017. Here a few of the noteworthy ones against Bitcoin: Even though, blockchain technology offers a high level of security, unfortunately, crypto-exchanges and ICOs don’t offer the same level of protection for their customers. While a great deal of the cyber attacks occurred at Bitcoin exchanges, hackers have been able to help themselves to the digital assets of most exchanges some even repeatedly. These attacks are nothing new to the crypto-community but with market caps soaring to new astronomical highs, we can expect cyber attacks to continue to soar.

Even the smartest criminals get careless and blockchain technology continues to be a bonafide weapon for combating and prosecuting crimes.

Even though, blockchain technology offers a high level of security, unfortunately, crypto-exchanges and ICOs don’t offer the same level of protection for their customers. While a great deal of the cyber attacks occurred at Bitcoin exchanges, hackers have been able to help themselves to the digital assets of most exchanges some even repeatedly. These attacks are nothing new to the crypto-community but with market caps soaring to new astronomical highs, we can expect cyber attacks to continue to soar.

Even the smartest criminals get careless and blockchain technology continues to be a bonafide weapon for combating and prosecuting crimes.

Final Take

The anonymity promised by cryptocurrency is a contradiction in itself because their blockchain reveals an entire history of all transactions for the public to see including law enforcement! Also, it really needs to be underlined, for the normal users of cryptocurrency, it means linking a normal bank account to an e-wallet. Anyway, governments have already started regulating cryptocurrency. With that said, miners, exchanges, and e-wallets who conduct transactions that use stealth like technologies (e.g. zero-knowledge proof) would most likely be placed on a sanction list blocking these funds until the financial institution has conducted an enhanced due diligence on the customer and the transaction all to the expense of the customer. At the moment, no other currency offers more anonymity and stability for money launders and terrorist than fiat currency…cash is still king for the time being Written by Paul Hamilton“Top Misconceptions of Cryptocurrency as a Payment System”

Which can be read on Amazon Kindle Unlimited for Free You can find more interesting articles by visiting us on one of the following platforms: AML Knowledge Centre (LinkedIn) or Anti-Bribery and Compliance at the Front-Lines (LinkedIn)

Which can be read on Amazon Kindle Unlimited for Free You can find more interesting articles by visiting us on one of the following platforms: AML Knowledge Centre (LinkedIn) or Anti-Bribery and Compliance at the Front-Lines (LinkedIn)