by Admin | Anti-money laundering

Preparing for the European Union Sixth Money Laundering Directive

Anti-money laundering (AML) law is constantly evolving. And necessarily so, given the increasingly sophisticated methods and technologies that criminals and terrorists use to move illegally earned funds through their networks. In the European Union, companies currently have until 10 January 2020 to comply with the current directive on money laundering (5MLD). And the European Parliament already approved, on 12 September 2018, a proposal for the EU’s next round of AML legislation, known as the sixth anti-money laundering directive (6 MLD) – just six months after the formal adoption of the fifth.

This is especially important because 6MLD represents a significant broadening of the scope of AML. One thing that is already abundantly clear is that it will not only affect companies based in Europe but also companies that have clients or subsidiaries in Europe. Thus, for example, there should be no talk of “Brexit uncertainty”. While the United Kingdom may not be directly bound by 6 MLD, and it is unclear as to whether it will adopt equivalent legislation for domestic purposes, British companies doing business in the EU will certainly need to comply.

So, what are the main points of 6 MLD?

A broader definition of predicate crimes

First, it offers a much tighter definition of what constitutes a money laundering crime, referred to in 6 MLD as “predicate crimes”. The aim here is that “the definition of criminal activities which constitute predicate offences for money laundering should be sufficiently uniform in all Member States”. The directive explicitly lists 22 categories of criminal activity. Member states must introduce national legislation to pursue and punish such activity if they have not already done so. Whereas most of these 22 categories, such as racketeering, drug and human trafficking, are obvious and well-established money laundering crimes, some of the newer predicate crimes are rather more nuanced. For example, legislators and corporate counsels will need to study a body of existing EU legislation to find out what 6MLD means in terms of “environmental crimes”, while other predicate offences, in particular cybercrime, tax crimes, and cryptocurrency present ever-moving targets.

Having digested the scope of these predicate crimes, firms will then have to conduct an impact analysis of the risk factors presented to their business models and the measures and controls they will need to introduce to ensure compliance. The enlarged scope of the directive means every company will need to seek advice and adapt accordingly.

6 MLD will also harmonise the penalties for anyone found guilty of money laundering offences within EU Member States, with a maximum of four years’ imprisonment. Currently, the severity of punishments for such crimes varies considerably.

Extension of liability

Until now EU law has focused the application of corporate liability to companies operating in regulated sectors, such as banking. Under Article 7 of 6 MLD, any company or legal person operating in an EU Member State can now be held criminally liable for failing to prevent money laundering – so this is also a significant extension of the scope of AML legislation. In concrete terms this means that company executives who are either aware of criminal activity, or who do not provide appropriate supervision or control over employees who enable money laundering, will be held liable and can be prosecuted.

Enhanced international cooperation

The new directive reiterates the EU’s commitment to combating money laundering by “enabling more efficient and swifter cross-border co-operation between competent authorities”. This commitment extends beyond EU and the European Economic Area. Essentially, local jurisdictions will be obliged to share information if there is a possibility to prosecute offences in more than one Member State.

The directive also explicitly addresses the fact that criminal activity may take place in one jurisdiction while the money laundering takes place another, the so-called principle of “dual criminality”. As the preamble to the directive states, “Given the mobility of perpetrators and proceeds stemming from criminal activities, as well as the complex cross-border investigations required to combat money laundering, all Member States should establish their jurisdiction in order to enable the competent authorities to investigate and prosecute such activities. Member States should thereby ensure that their jurisdiction includes situations where an offence is committed by means of information and communication technology from their territory, whether such technology is based on their territory or not.”

Article 10 of 6 MLD specifically addresses this issue. In particular, it is likely to make a material difference in relation to the reporting and prosecution of new predicate crimes such as the facilitation of foreign tax evasion.

Domestic law may be tougher

While 6 MLD aims to harmonise legislation across Europe and to enhance international cooperation, it is worth noting that some jurisdictions already have tougher legislation in place in some areas. The United Kingdom’s most recent overhaul of its domestic AML legislation was the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, which came into force in June 2017. This implemented the EU’s fourth money laundering directive and imposes a maximum term of 14 years’ imprisonment in England and Wales for the principle money laundering offences, significantly stricter than the maximum four-year sentence proposed by the 6MLD.

Post-Brexit the UK will need to decide whether to adopt the broader list of predicate crimes and adopt the provisions of 6 MLD or amend existing legislation. But even if it does not, it is already clear that companies doing business elsewhere in Europe will need to review their risk position and AML processes. As far as AML is concerned, there will be no bonfire of the regulations!

There is no silver bullet

Smaller financial institutions will find it difficult to keep up with yet another regulatory round in AML. They will come under a lot of pressure to invest in new “future-proof” technologies and hear a lot of buzzwords. There is no shortage of RegTech companies out there, most of which have sprung up in recent years, who are keen to give you their sales pitch. Deloitte lists more than 60 companies specializing in the KYC and AML space alone.

The truth is, however, that there is no absolute failsafe solution and no silver bullet. Larger financial institutions that have invested billions in highly sophisticated artificial intelligence and machine learning solutions for AML compliance now find that real work has only started.

To minimize the risks of non-compliance while keeping costs under control, companies would do better to review and strengthen their AML processes, especially around know your customer, before committing to any major technology investments. I set out some of the most important considerations in this earlier post. However, each organization is different, and it is important to find the best technology fit. Therefore, I recommend seeking independent advice on how best to invest in improving data quality and automating the most time-consuming parts of your AML workflow before purchasing technology for the sake of technology.

Author: Paul Hamilton

Go to the AML Knowledge Centre LinkedIn https://www.linkedin.com/groups/8196279/ to read more articles on AML and financial crime. Also, we look forward to your input!

“Top Misconceptions of Cryptocurrency as a Payment System”

Which can be read on Amazon Kindle Unlimited for Free You can find more interesting articles by visiting us on one of the following platforms: AML Knowledge Centre (LinkedIn) or Anti-Bribery and Compliance at the Front-Lines (LinkedIn)

Picture:

H_Ko – Shutterstock

by Admin | Cryptocurrency

Bitcoin vs. fiat is more than an academic argument. It’s a fierce battle between a manipulated monetary regime and one of honest weights and measures. It’s time for you to envision the benefits of a decentralized, non-manipulated monetary system.

Out of Thin Air

Fiat currency is any medium of exchange the government deems as legal tender. A $20 bill in your pocket buys $20 worth of goods and services. It’s only paper (muslin) with ink and a special electronic doodad embedded in it. Probably costs pennies to make. It’s backed by nothing of tangible value (gold, silver, land, etc). It’s money only because the US Treasury and Federal Reserve (Fed) say it is.

From Sound Money to Broken Promises

Before 1913, only the US Congress had currency creation authority. Every new dollar was backed by gold and silver in Fort Knox. This backing of USD with gold and silver ceased on August 15, 1971. That’s when President Nixon refused to honor France’s demand for physical gold in exchange for its USD reserves. The USD has been decoupled from the gold standard ever since. Worse, the national debt is now in a nonstop, parabolic ascent.

Dialing for Dollars

When the US Treasury needs money, they give the Federal Reserve (Fed, a privately owned, for-profit corporation) a ring. Say the Treasury needs $50 billion dollars. The Fed creates an electronic checkbook with a $50 billion account balance. In exchange for the cash, the Treasury gives the Fed $50 billion dollars of Treasury bonds. You can learn more about this financial alchemy in Robert Prechter’s book, Conquer the Crash.

Taxpayers on the Hook

You’re probably wondering who pays the interest on that $50 billion batch of bonds, right? Surprise! You’re the one who pays the interest, via your US federal tax bill.

Can’t be, you say?

You need to consider this quote taken from the Grace Commission Report of 1984:

“….100 percent of what is collected is absorbed solely by interest on the federal debt and by federal government contributions to transfer payments. In other words, all individual income tax revenues are gone before one nickel is spent on the services [that] taxpayers expect from their government.”

Let’s say your Federal income tax bill is $9,000 for 2018. Most of your tax liability will pay the Fed interest on the bonds. Part of it will cover federal pension payments. None of your tax payment will pay for any government services.

US Dollar creation and income taxes are inseparably linked. Photo by: Capturing the human heart at Unsplash.com.

Before 1916, there was no US Federal income tax. The US flourished for 140 years without one. Do you find it interesting that the income tax came to be just three years after the Fed’s creation?

Even More Disturbing

Okay, part of your income taxes is used to pay interest to the Fed. None of your income taxes pay for government services. Where does the money needed to run the US government actually come from? That’s a great question!

The US Treasury sells interest-bearing bonds to investors. Other revenues are generated via import duties, gasoline taxes, airline ticket taxes, etc. The revenue shortfall is covered by additional Fed debt for moneyexchanges. As a result, the US national debt keeps on climbing at an exponential rate. Paying it off is impossible in a debt-based monetary system.

The debt-based fiat monetary system perpetually transfers part of your wealth to the central bank’s owners.

Bitcoin vs. Fiat: Can We Break the Link?

Bitcoin isn’t backed by physical commodity stores of value. However, Bitcoin’s controlled supply lends stability to its value, similar to asset-backed paper currency. But if you buy Bitcoin in USD, sell it in USD, and then pay US taxes on it, your transactions are inseparably linked to the fiat monetary system. Such limitations effectively cripple the vast potential of Bitcoin.

Storm Clouds Brewing

Central banks realize that cryptocurrencies pose a threat to their financial dominance. As more people transact in Bitcoin, the demand for fiat drops. That’s bad news for USD valuation, especially as Russia, China, and others create non-USD financial networks. A sudden devaluation of USD would increase consumer prices. Economic chaos might ensue.

An End Run

Bitcoin transactions might be restricted by law and fiat currency demand would be protected by such legislation. The Central banks may eventually decide to protect their turf with such tactics.

They might also introduce their own centralized digital currencies. According to this recent quote from Christine Lagarde, director of the International Monetary Fund (IMF):

“I believe we should consider the possibility to issue digital currency,” Ms. Lagarde said in a speech at a conference in Singapore. “There may be a role for the state to supply money to the digital economy.

The advantage is clear. Your payment would be immediate, safe, cheap and potentially semi-anonymous… And central banks would retain a sure footing in payments.”

The IMF is the banker to worldwide central banks. Surely they will protect their members’ financial interests. Therefore, it seems unlikely that their version of a digital currency will resemble Bitcoin.

The more probable outcome is an electronic version of the current fiat monetary system. Therefore, you would continue to pay for the interest due for every debt for money exchange.

Bitcoin Needs a New, Libertarian Nation-State in Which to Flourish

For you to fully realize Bitcoin’s potential, the currency may need to become the lifeblood of a newly-birthed nation.

Imagine the possibilities for your life with:

- A Libertarian nation based on principles of honesty, accountability, transparency, and egalitarianism.

- A national currency based on a physical commodity-backed (oil, metals, grains, land, etc.) version of Bitcoin.

- A fully-backed, auto-adjusted Bitcoin supply tuned to current economic activity.

- A financial system absent of economic booms and busts.

- A monetary system free of government deficit spending and central banks.

- Stable consumer prices and low interest rates.

- A direct democracy that eliminates the need for presidents, politicians, fiat money, and bureaucrats.

- Smart contracts for consumers and producers that eliminate the need for government agencies.

You may see the formation of sovereign, Libertarian-ideal nation-states within the next 10-15 years. Cryptocurrencies and the blockchain might provide the honest financial foundation needed for such nation-states to succeed. You would have an equal opportunity to prosper. If your business fails, there would be no bailouts for you. No central bank could profit from fiat currency schemes.

Consider this quote from a widely-read book:

“But new wine must be put into new bottles; and both are preserved”

-Luke 5:38 KJV

That simple logic applies to Bitcoin and other cryptos. They can’t harmoniously coexist alongside a fiat, debt-based money system. We must deploy honest, manipulation-free currencies into a corruption-free economic and societal model.

Only then would you enjoy the new wine of Bitcoin. The battle of Bitcoin vs. fiat would finally be over.

This article was originally published on Coincentral.

Author:

Donald Pendergast

“Top Misconceptions of Cryptocurrency as a Payment System”

Which can be read on Amazon Kindle Unlimited for Free You can find more interesting articles by visiting us on one of the following platforms: AML Knowledge Centre (LinkedIn) or Anti-Bribery and Compliance at the Front-Lines (LinkedIn)

by Admin | Cryptocurrency

Upcoming Cryptocurrencies are Causing a Financial Evolution

In 2009, Satoshi Nakamoto created Bitcoin partly in response to the 2008 financial collapse. He envisioned a purely peer-to-peer financial system in which you don’t have to trust third-party institutions to make transactions. Now, there are hundreds (if not thousands) of upcoming cryptocurrencies that have built on Bitcoin’s foundation. They’re here to enhance the financial industry in the same way that Bitcoin did for simple transactions.

In this article, we examine the impact that these upcoming cryptocurrencies are having on the world’s largest industry – finance.

Existing Institutions Operate More Efficiently

With products already available, some cryptocurrencies, most notably Ripple and Stellar, are working with existing institutions to make their systems more efficient.

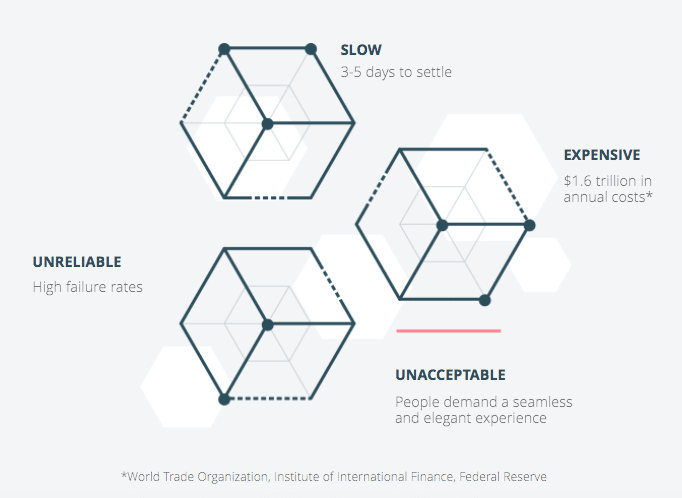

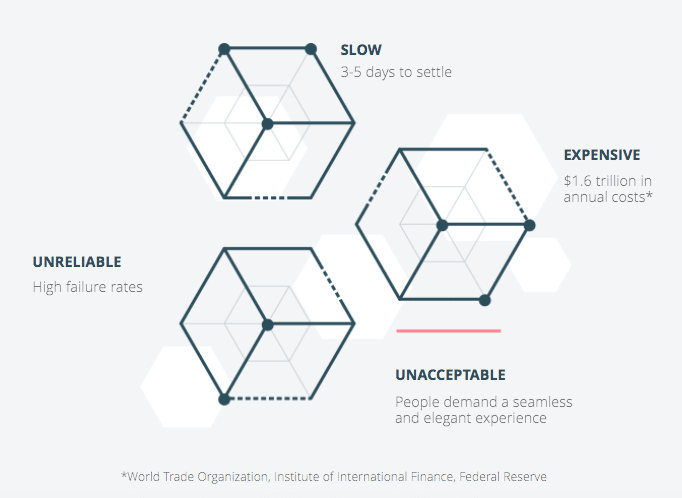

The Ripple Transaction Protocol (RTXP) is a network of financial institutions on the blockchain. Any company using the protocol can transact with any other participant at a fraction of the time and cost it would take in a traditional system. This is especially ideal for global payments which can typically take 3-5 days and cost participants $1.6 trillion annually.

Started by a Ripple team member, Stellar is making a similar impact on the financial industry. The project has joined forces with IBM to also facilitate better cross-world payments. Some Stellar supporters argue that the project’s token economics lead it to be a more decentralized solution than its counterpart, Ripple. However, there’s room for both in a massively interconnected world.

You Have Full Control of Your Money

One of the greatest values that blockchain brings to the financial industry is monetary control. With this technology, you no longer have to trust a bank with your money. It’s stored on an immutable ledger that’s nearly impossible to manipulate or hack.

Really, any upcoming cryptocurrency serves this purpose. With them all using blockchain technology (or something similar), your faith is in the coin’s open-source code rather than any corruptible institution. With cryptocurrency, it’s impossible for someone to freeze your funds or tell you where and when you can spend your money.

Your wallets, private keys, and funds are entirely in your control. This is rule number one for any reputable cryptocurrency.

Transactions are Truly Peer-to-Peer

Blockchain technology also eliminates the need for middlemen in transactions. And, there are plenty of upcoming cryptocurrencies using that feature for good use. The big players like Bitcoin and Litecoin specialize in these types of transactions, but there are some smaller projects you should be aware of as well.

Nano has gained some popularity for its lack of fees and near instantaneous transaction times. Because Nano uses the directed acyclic graph (DAG) algorithm instead of a typical blockchain, the network becomes more efficient when more people are using it. Although not as battle-tested as big boy Bitcoin, the cryptocurrency could have a promising future for free peer-to-peer payments.

Another project, Request Network, is expanding beyond simple peer-to-peer payments by building a Paypal-like blockchain interface. Using their platform, you send and request money while avoiding third-party intermediaries. But, the team isn’t stopping there. They’ve created an entire mind map for all of the ways they want to change the financial industry. Crowdfunding, payments, point-of-sale – the team is attempting to fix it all.

More People Have Access to Banking Services

Most importantly, upcoming cryptocurrencies are bringing banking services to the 2 billion people around the world without banks. Whether they can’t afford it, they don’t qualify, or the countries they live in are lacking in banking institutions, this group of people is commonly underserved.

Many upcoming cryptocurrencies are making bank services more affordable and more available to the unbanked. With Stellar, financial institutions can afford to offer low-cost accounts as well as loans with more favourable interest rates. Now, a business owner in a developing country can more easily get a loan, stimulating the economy in the process.

Even cryptocurrency exchanges are having an unlikely effect on the financial industries of unbanked nations. For example, Binance recently announced an initiative to transform and improve Uganda’s economic landscape. They’ll be doing so by proving youth employment through blockchain.

An Entire New Financial Infrastructure Could Exist

Moving past traditional financial structures, it’s even possible that a new technological infrastructure will be powering the entire financial sector soon.

Wanchain is just one project attempting to build finance from the ground up. Instead of tying into the current infrastructure, they’re building their own. Their goal is to create an entire blockchain-based ecosystem in which anyone can build financial services on. Wanchain’s success could mean that physical banks disappear, becoming (decentralized apps) dapps on the blockchain instead.

This is Just the Beginning

Blockchain technology is already beginning to have a massive effect on the financial industry. With established cryptocurrencies like Bitcoin, you get a secure store of value, trustless peer-to-peer payments, and complete monetary control.

Other upcoming cryptocurrencies are making significant impacts as well. Beyond digital transactions, newer projects are specifically focusing on helping the unbanked, making blockchain technology more scalable, and providing functional interfaces.

As these and more cryptocurrencies continue to improve the finance sector, it won’t be long before our current financial infrastructure is a thing of the past.

This article was originally published on Coincentral.

Author:

Steven Buchko

“Top Misconceptions of Cryptocurrency as a Payment System”

Which can be read on Amazon Kindle Unlimited for Free You can find more interesting articles by visiting us on one of the following platforms: AML Knowledge Centre (LinkedIn) or Anti-Bribery and Compliance at the Front-Lines (LinkedIn)

by Admin | Cryptocurrency

Blockchain technology is transforming what it means to banks in major ways. People from all over the world are learning about the advantages this technology offers, and every day new and more advantageous blockchain startups are entering the marketplace. The open nature of the decentralized economy is truly inspiring, and for the first time in history, there is a real opportunity to solve many of the problems associated with our financial system.

A recent study conducted by the World Bank Organization revealed that more than two billion people around the world lack adequate access to financial services. These individuals are forced to conduct all of their transactions in cash which can be dangerous as most of these areas are located in developing nations. The study also revealed that over 50% of adults in the poorest households are unbanked.

This lack of financial inclusion is seriously hindering world economic development, and in many countries, there has been considerable effort put forth to tackle this problem. Unfortunately, many of these programs lack the technological ability to solve these problems. Considering that the problem is inherent in the current financial system, there is little hope that a solution will come about using the current centralized economic stance.

Why Blockchain is the Answer

A new decentralized approach is needed to provide these individuals with fair and equal access to financial services. The centralized nature of our current banking system requires a huge infrastructure to implement and the investment capital to institute these expensive additions is not practical in many poorer nations; many of which, still lack access to basic infrastructures such as roads and hospitals.

Advantages of Blockchain

Blockchain technology could be instituted in a manner that is both cost-effective and highly efficient. Thanks to blockchain technology, everyone now has equal access to financial services on a global scale. The transparent and immutable nature of blockchain technology makes it perfectly suited to handle these real-world problems.

Un-Banked Populations

Creating a blockchain-based access point for these unbanked populations would be much easier than attempting to extend the current cumbersome banking system into these regions. Many of these countries are politically unstable and widespread corruption has curbed the desire for large institutions to enter the market. Corrupt governments are controlling the funds entering their regions and restricting the people’s ability to economically develop.

Open Banking

The implementation of a blockchain-based banking system in these regions would help to curb the corruption currently running rife in the banking system. The transparent nature of blockchain technology is ideal in preventing government and banking officials from skewing the books. Corruption is not regulated to just developing countries, as we have already seen in the multiple banking bailouts of the last few years.

Many of the citizens of developing countries such as Zimbabwe are in this exact position. The people have lost faith in their government after years of repression and what basically amounts to financial terrorism. Skyrocketing inflation and corruption have made blockchain alternatives flourish in this country and a new generation of blockchain-aware investors is emerging.

Zimbabwe Soldiers Waiting for Housing

The change throughout Africa is real and in March of this year, South Africa hosted its fourth edition of their Blockchain Africa conference in Johannesburg. This saw record attendance including representatives from the financial, legal, and technologies sectors of the country.

This growth makes sense as blockchain technology is the smartest alternative for South Africans; many of which rely heavily on remittance payments sent from countrymen working abroad. These payments can now be sent for a fraction of the cost and directly via blockchain technology.

Business Payments

The Peer-to-Peer nature of blockchain technology makes it the ideal choice for businesses looking for a more efficient solution than the current lackluster systems in place. There are now multiple cryptocurrency merchant processors at a business’s disposal and by implementing these technologies, a business can easily enter the global economy from anywhere in the world.

Global Payments

In its current state, the global economy can be punishing on individuals who attempt to offer their services or products internationally. The dollar-focused central banking system makes it very difficult for countries with less influential fiat currency to become important players in the world economy. Converting currency internationally can be an expensive task and this hinders many entrepreneurs’ growth.

During the conversion, a company can lose significant buying power if their currency is not of equal value to the other parties involved. This is a skewed financial system that leans heavily towards the colonial powers that first instituted these systems in these countries 500-years prior.

Blockchain Technology Allows For Open Access to the Global Economy

Blockchain users can avoid this pitfall. The decentralized economy is not owned by any country and the largest player in the sector, Bitcoin, isn’t affiliated with any organization or region in particular. One can only assume that Satoshi, the anonymous creator of BTC, must have had the foresight to see that these corrupt organizations would step in and try to regulate or commodify his creation into another tool for their power-hungry strategies. To avoid this confrontation, the creator of BTC has decided to stay anonymous for over 9 years.

Due to the fact that there is no way to contact Satoshi, governments are forced to tiptoe around the issues of regulation, whereas, in a usual scenario, they would just confront the company’s owner and demand they meet their demands or else. The only thing these countries can do to Satoshi is send him BTC to his known BTC address; as that is the extent of the knowledge of this person’s identity they have.

A Blockchain Future

The undeniable efficiency of blockchain technology makes it the obvious choice to solve the world’s current financial system woes. A decentralized financial system would allow for equal access on a global scale and further help those who are being drowned in corruption to seek a legitimate alternative to the current system. Hopefully, blockchain technology can continue to provide untethered access for these individuals who are seeking to become active members of the global economy.

What do you guys think? Is the world ready for a fully transparent banking system?

This article was originally published on Coincentral.

Author:

David Hamilton

“Top Misconceptions of Cryptocurrency as a Payment System”

Which can be read on Amazon Kindle Unlimited for Free You can find more interesting articles by visiting us on one of the following platforms: AML Knowledge Centre (LinkedIn) or Anti-Bribery and Compliance at the Front-Lines (LinkedIn)

by Admin | Cryptocurrency

The North Korean government is currently facing a flurry of accusations related to cryptocurrency hacks, cryptojacking attacks, and money laundering. Its regime, which is currently reeling from sanctions imposed by the United States government, is believed to be backing cryptocurrency scams and hacks to obtain badly needed funds.

Cryptojacking in South Korea

According to the latest reports, the South Korean government is blaming the North Korean regime for launching a string of cyber attacks against the country.

Going by an audit carried out by the country’s National Intelligence Service, Pyongyang is using cryptojacking and hacking techniques to mine Monero using computers located in South Korea.

The country is apparently spreading links through social media and emails that send users to malicious websites prepped for cryptojacking attacks. North Korea’s cyber attack units are also accused of relentlessly probing South Korean networks and intelligence systems to obtain sensitive information.

According to the NIS report, their teams may also soon be able to launch attacks using Artificial Intelligence technology.

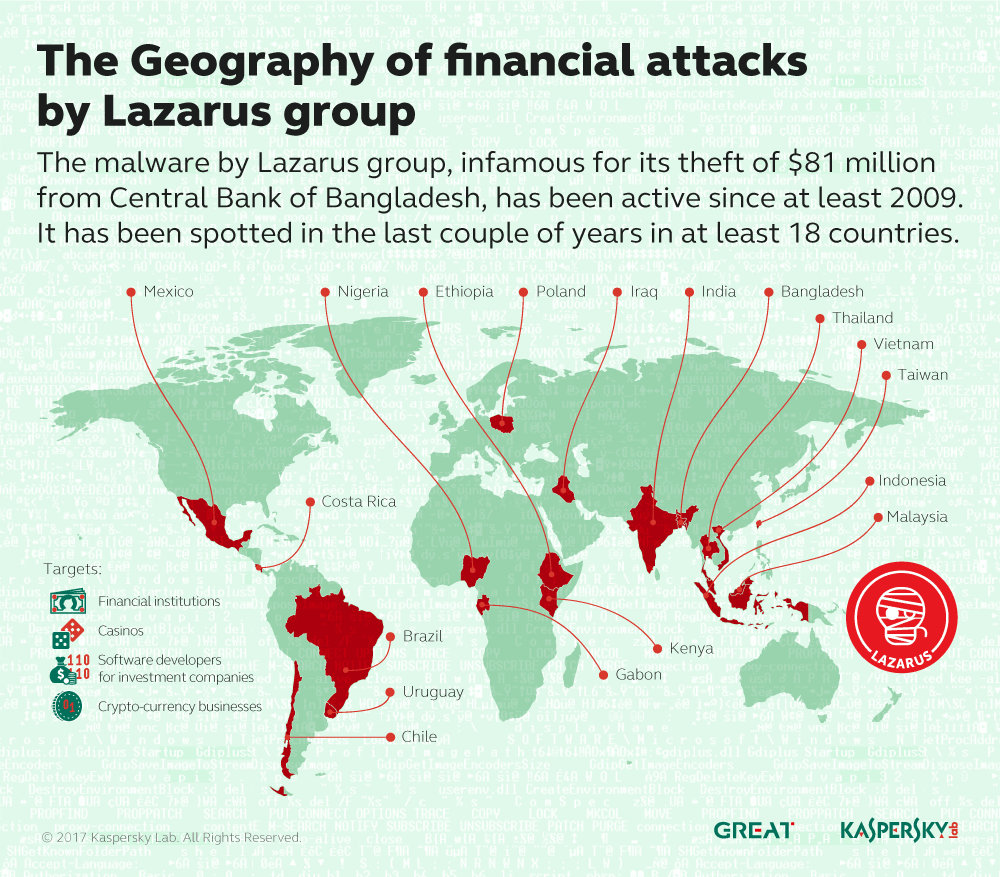

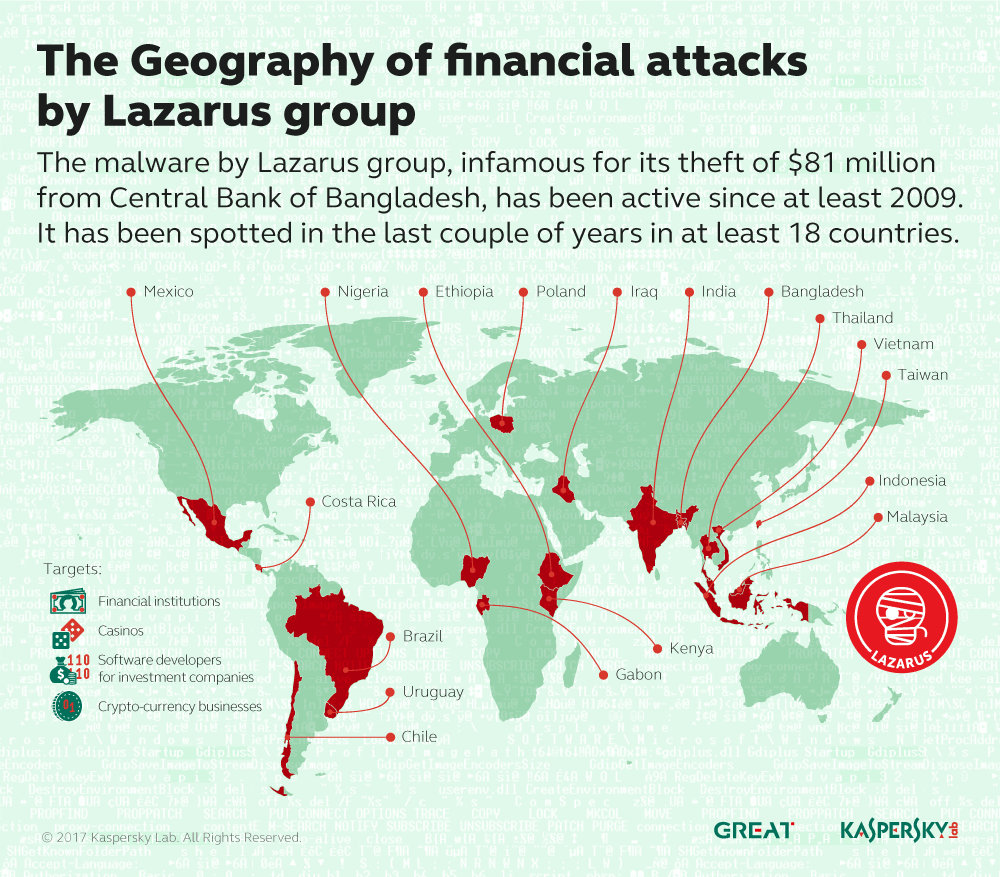

The Regime Is Sponsoring Cryptocurrency Hacker Groups

Attacks on cryptocurrency platforms have been on the rise in the past two years, with sophisticated hacker groups specifically in China and Russia believed to be behind the schemes. According to a recent report released by the cybersecurity firm, Group-IB, Pyongyang also backs some of the most successful hacker syndicates on the planet, the most notable being the Lazarus hacker unit. In most cases, the syndicates target world financial institutions and cryptocurrency trading platforms.

With over a billion dollars worth of cryptocurrencies stolen from various platforms over the past two years, Lazarus was specifically responsible for syphoning off over $500 million worth of digital assets from exchange networks.

Cryptocurrency exchange platforms that have fallen victim to its schemes include Bithumb, Yapizon, YouBit, Coinis, and Coincheck. Such groups commonly use spear phishing for their exploits.

Lazarus has successfully attacked several cryptocurrency exchange platforms including Bithumb, Yapizon, YouBit, Coinis, and Coincheck. (Image Credit: Kaspersky)

North Korea Backing Scam Coins

Pyongyang cyber units have also been involved in a spate of scam coin setups to illicitly obtain funds from unsuspecting investors. Among recent discoveries was a scam coin dubbed Marine Chain, which the state of Ontario declared as a fraud. Now defunct, it allowed for the tokenization of marine vessels.

Clients lured in by the scheme lost their investments on the platform, allegedly set up by enablers in Singapore. Its website was hosted on four different IP addresses on different occasions. Some users also noted striking similarities with another platform called shipowner.io.

North Korean scammers may also be behind another scam coin dubbed Stellar Holdings or HOLD. Unusual activity involving the HOLD altcoin was detected between the months of March and August. Experts started to notice significant data transfer volumes during this period. Several network nodes indicated significant activity, especially during June.

The team behind the coin reportedly generated interest and revenue at the beginning of the year through a technique called stacking. It involves allowing miners to mine the cryptocurrency and add to its value and growth momentum before giving them permission to trade. Participants generally take on significant risks while indulging in such schemes because trades and time-frames are limited by coin developers.

There is also the real risk that the coin will depreciate in value before miners can trade. In August, the HOLD coin was apparently rebranded to HUZU after being listed and delisted on several cryptocurrency platforms. The change reportedly led to major financial losses among its investors.

(Featured Image Credit: Pixabay)

This article was originally published on Coincentral.

Author:

“Top Misconceptions of Cryptocurrency as a Payment System”

Which can be read on Amazon Kindle Unlimited for Free You can find more interesting articles by visiting us on one of the following platforms: AML Knowledge Centre (LinkedIn) or Anti-Bribery and Compliance at the Front-Lines (LinkedIn)