by Admin | Anti-money laundering

Tighter U.S. CDD requirements and what they mean for foreign banks…Deadline to Comply is MAY 2018

In the aftermath of the Panama Papers controversy, governments have been discussing ways to promote more financial transparency.

Financial Crimes Enforcement Network (FinCEN) has proposed tighter Customer Due Diligence requirements (CDD). requiring covered financial institutions to also verify the identity of beneficial owners those behind legal entity customers. The addition of a “fifth pillar” requires appropriate risk-based procedures for the ongoing customer due diligence monitoring. Covered Financial institutions will have to comply with these new requirements by May 11, 2018.

Getting in on the act, the Treasury Department proposed legislation that, if enacted, would require all companies formed in the United States to report beneficial ownership information to the Treasury Department.

The final legislative proposal by the Justice Department will surely keep foreign banks and governments up at night. This proposal would enhance the ability of law enforcement officials to obtain information from domestic and foreign banks so they can investigate and prosecute money laundering and terrorist financing cases. The proposal doesn’t stop there it would also allow the Justice Department the power to link a broader set of crimes to money laundering and terrorist activities.

These regulatory changes and legislative proposals by the U.S. government is a demonstration of strength to financial institutions around the globe that the United States will not tolerate money laundering or terrorist financing.

Financial institutions should consider these key takeaways:

- FinCEN’s model certification form will not be required and will not trigger a safe harbor.

- Financial institutions will be able to obtain the required information on beneficial owners by any means they deem appropriate.

- The individual opening the account on behalf of the legal entity customer must certify, to the best of their knowledge, the accuracy of the information.

- Financial institutions will be required to identify at least one and as many as five beneficial owners for each new account opened by a legal entity customer.

- The rule defines a beneficial owner as each individual, if any, who directly or indirectly owns 25 percent or more of the equity interests of a legal entity customer and a single individual with significant responsibility to control, manage or direct a legal entity customer (e.g., chief executive officer, chief financial officer, chief operating officer, managing member, president, vice president).

- Financial institutions will have to identify one beneficial owner with significant control, regardless of whether any individual meets the 25 percent threshold.

- Financial institutions will be required to collect the beneficial ownership information every time a new account is opened, even if the customer has existing accounts for which the institution already obtained such information.

- Financial institutions will have the discretion to identify additional beneficial owners or to establish a lower percentage threshold for beneficial ownership based on their own risk assessment.

- Financial institutions are permitted to use information gained through the legal entity customer regarding the identity of its beneficial owners, provided the institution has no reason to question the reliability of the information.

- Financial institutions will need to verify the identity of beneficial owners, but are not obligated by means of research to prove whether that individual is, in fact, a beneficial owner.

- The burden to identify beneficial ownership will largely lie on the legal entity customer and not on the financial institution, however, institutions will want to consider implementing risk-based policies to assess the reliability and avoid over-reliance on a customer’s representation.

- Financial institutions will not be categorically required to gather beneficial ownership information for accounts established before the applicability date, however, they should consider collecting beneficial ownership information for existing accounts on a risk-basis.

- All accounts opened on or after the deadline date will need to apply these new rules to them. Financial institutions are still expected to gather beneficial ownership information during routine monitoring for accounts opened prior to the deadline date.

The two main takeaways from FinCEN’s new “Fifth Pillar”, which codifies existing obligations:

- Financial institutions must understand the nature and purpose of all customer relationships for the purpose of developing a customer risk profile;

- Financial institutions must conduct ongoing monitoring to identify and report suspicious transactions and, on a risk-basis, maintain and update customer information.

Before, these two elements were implicitly required within an institution’s suspicious activity reporting obligations. However, it would be wise for financial institutions to update their internal procedures to satisfy these obligations.

Furthermore, FinCEN has emphasized that beneficial ownership information should be treated similarly to a customer identification program this would help to ensure compliance with other sanction’s requirements such as OFAC’s 50 percent rule. Beneficial owner information could also be useful in helping financial institutions to detect whether transactions are “by” or on “behalf” of the same person.

Key focuses of the European Union’s CDD requirements.

- The Fourth AML Directive, which member states have to comply with by June 2017, will also strengthen existing CDD and beneficial ownership requirements.

- EU member states have to establish central registers of beneficial owners and make them accessible to financial institutions and other designated parties.

- Member states have the authority to set lower beneficial ownership thresholds than the currently mandated threshold of an interest exceeding 25 percent.

The EU’s CDD requirements differ in certain respects from FinCEN’s final rule:

- The EU requirements are centered around a risk-based approached, whereas FinCEN provides specific requirements.

- Although both use “ownership” and “control” thresholds to define beneficial owners, FinCEN’s requires that only one individual be identified under the “control” threshold while the fourth directive does not specify how many need to be identified. For instance, where multiple individuals may exercise control over a legal entity a financial institution in the EU may have to identify more than one individual under the “control” threshold in accordance with the institution’s assessment of risk.

- The fourth directive also does not specifically provide for reasonable reliance on representations made by customers regarding their beneficial owners. This could suggest that EU regulators may expect financial institutions to conduct appropriate risk-based due diligence to independently vet the reliability of the information provided by a customer.

One thing is for sure that financial institutions with global compliance programs this all adds an additional layer of complexity and the differences between U.S. and EU CDD requirements will need to be managed, especially if their approach is to implement the strictest requirements of the jurisdictions in which they operate.

Posted by Paul Hamilton

by Admin | Anti-money laundering

The internet has opened the door to purchase anything, I do mean anything, from any part of the world. These items can be paid for instantly through electronic payments. These transfers can be made from everywhere with ease and speed allowing greater anonymity if desired.

It’s also safe to say that Financial Technology has lagged many other industries in their overall adaptation of technological innovation. This sudden surge in FinTechs while not all are revolutionary business models they all seem to have a common denominator and that is to take advantage of the high operating costs and significant decline in the social reputation of banks.

At a time when many financial institutions are trying to become more efficient, lower cost and improve customer relationships.

Innovation has never been a bad thing and it keeps economies competitive and industries efficient. There is no reason to believe that FinTechs won’t have a positive effect on the banking industry. But as banks surrender more and more of their business too hungry entrepreneurs’ AML regulators will find themselves at crossroads on important decisions.

“Assessing past situations, there have been many lessons learned from which can be seen as a driving force behind the regulator Sandbox”

By far a regulator’s most important task is making sure that the financial system is not being improperly used for money laundering or terrorist financing. While at the same time ensuring that AML regulation doesn’t hamper innovation, disrupt competition but also acting as an interface making sure that these new business models are understood by all relevant legal authorities.

For example, in a recently highlighted case involving a Bitcoin trader, felony charges against Michell Espinoza for engaging in a money service business and money laundering were thrown out by Judge Pooler. She noted that while “the court is not an expert in economics; however, it is very clear, even to someone with limited knowledge in the area, the Bitcoin has a long way to go before it is the equivalent of money. She also made the point, “this court is unwilling to punish a man for selling his property to another when his actions fall under a statute that is so vaguely written that even legal professionals have difficulty finding a singular meaning.”

The take away from Judge Pooler’s statements are that relevant legal authorities clearly don’t have enough knowledge on Bitcoin or business models surrounding Bitcoin, nor how it might be exploited by criminals.

Let’s take a step back to look at the bigger picture. The truth is that all banks, are under enormous pressure to minimize their exposure to money laundering and stop terrorist financing. It’s no secret that this is driven by the attitude of the US lawmakers and regulators.

Look at the impact AML regulation has had on correspondent banking relationships, as a majority of trade financing is done in US currency. This in itself creates enormous challenges for banks not accustomed to US AML Laws. For those institutions that are experienced in US AML laws, they either spend time and money to conduct enhanced due diligence on the local bank ensuring that its anti-money laundering policies will hold up against US AML regulation or rethink their strategy. Therefore, if a bank has a limited number of transactions, and has to invest $15,000 – $50,000 to achieve adequate due diligence on a single client, it can reduce the appeal of working in a particular country.

In a similar manner, both the Remittance industry and the banking industry have had a pugnacious relationship as banks systematically terminated the accounts of money transfer services to avoid the risk of heavy money laundering fines. Causing legitimate firms to go out of business, leaving migrants workers with no safe way to send money home or less competition which will negatively impact the already high transfer fees.

“The Fintech Industry today and how the Regulator Sandbox is helping”

The total global investment from 2010 to 2015 reached about $50B. The geographies which have received the largest amount of investments in this time frame has been the US with about $32B, $5B across EMEA and Asia with $4B.

The largest area of investment is in payment processing and lending solutions (40 percent), however emerging technology such as the P2P blockchain popularized by Bitcoin and cloud-based technologies that add speed and security to financial networks are also strongly supported.

The 2015 EY FinTech adoption Index survey found that 15.5% of digitally active consumers have used at least two FinTech products within the last six months. As awareness of the available products and services increases, adoption rates could double within the year.

The survey went on to show that Hong Kong has the highest rate of FinTech use of all markets surveyed (29.1%). The United States has the second-highest adoption rate (16.5%), followed by Singapore (14.7%), the United Kingdom (14.3%), Australia (13%) and Canada (8.2%).

Given the fact, that the Fintech industry is growing faster than expected, which could mean greater opportunities, it should be as no surprise that many local governments and banks themselves want to leverage these opportunities.

“Ms. Jacqueline Loh, Deputy Managing Director of the Monetary Authority of Singapore, said, “MAS aims to provide a responsive and forward-looking regulatory approach that will enable promising FinTech innovations to develop and flourish. The sandbox will help reduce regulatory friction and provide a safer environment for FinTech experiments. We believe this will give innovations a better chance to take root.”

Not only do these regulatory sandboxes aim to provide a safe space for FinTechs, but as we seen with Bitcoin, innovation moves faster than regulators can adapt the rules, the sandbox gives regulators the opportunity to assess new innovation, market trends, and how these innovations might be exploited by criminals, before extending use to a broader market.

The end game for financial criminal activity is the placement their ill-gotten gains into legitimate banking organizations without raising an alarm. Once accomplished they are ultimately able to turn illegal assets into legal ones. Allowing the most ruthless criminals, to join society as legitimate business people and role models.

Striking the right balance between promoting innovation, protecting consumers and preventing financial crime requires collaboration with industry, it looks like regulation has learned from past lessons and is getting it right this time.

Posted by Paul Hamilton

by Admin | Anti-money laundering

A recently-issued ruling by a South Florida judge that Bitcoin is not money, but equates more to property, has law enforcement puzzled, they feel the legal ramifications of this ruling could make it much more difficult to bring charges against future money laundering crimes where virtual currencies are involved. Bitcoin like many other decentralized convertible virtual currencies (VCs) provide alternative digital payments platforms. The Bitcoin network was designed to serve as an electronic peer-to-peer (P2P) payments mechanism for ecommerce. The idea was to enable users to bypass financial institutions by directly transferring VC to each other and settling those transactions in near real time, thereby removing intermediate costs, such as transaction fees and payment uncertainty.

Judge Pooler’s ruling came in response to a case where the judge threw out felony charges against Michell Espinoza. At the time Michell Espinoza had an account on a website, localbitcoins.com, where he allegedly traded Bitcoin for a profit. The defendant was accused of transmitting (as a money services business) and laundering $1,500 worth of Bitcoins by detectives, from Miami Beach Police and the U.S. Secret Service, while acting undercover, who he had sold the virtual currency to for the purpose of buying stolen credit-card numbers from Russia.

On charges of engaging in a money services business, the judge issued the statement that “attempting to fit the sale of Bitcoin into a statutory scheme regulating money services businesses is like fitting a square peg in a round hole.” Bitcoin is not, she noted “backed by anything” and is “certainly not tangible wealth and cannot be hidden under a mattress like cash and gold bars.”

To the charges of money laundering, Judge Pooler clarified that money laundering is “commonly understood to be the method by which proceeds from illicit activity (“dirty money”) becomes legitimized.” The judge also mentioned that Florida law — states that a person can only be charged with money laundering if they engage in a financial transaction that will “promote” illegal activity — is way too vague to apply to Bitcoin. However, Judge Pooler says that there was no financial transaction because Bitcoin is not money.

Judge Pooler also noted that while “the court is not an expert in economics; however, it is very clear, even to someone with limited knowledge in the area, the Bitcoin has a long way to go before it is the equivalent of money. She also made the point, “this court is unwilling to punish a man for selling his property to another when his actions fall under a statute that is so vaguely written that even legal professionals have difficulty finding a singular meaning.”

The ECJ based it’s ruling on the Advocate General’s position that “virtual currency has no purpose other than to be a means of payment.” That means that in the European Union, for purposes of tax, bitcoin is considered – and taxed – as currency. By rule, in the EU, there is no tax on “currency, bank notes, and coins used as legal tender.” However, her ruling is in line with the position taken by the Internal Revenue Service (IRS). Last year, the IRS issued guidance to taxpayers in 2014 on how to treat Bitcoin – and other virtual currency – for federal income tax purposes. That guidance, IRS Notice 2014-21, states that Bitcoin and other “convertible” virtual currencies are to be treated as a capital asset. “Convertible” virtual currencies are generally defined as virtual currencies with an equivalent value in real currency or those that act as a substitute for real currency.

Espinoza’s attorney, “At least it gives the Bitcoin community some guidance that what my client did was not illegal,” Palomino said. “What he basically did was sell his own personal property. Michell Espinoza did not violate the law, plain and simple.”

The ruling has been praised by the Bitcoin community who believe this will encourage the use of the virtual currency while giving government agencies who have struggled to understand and regulate it more guidance.

A Miami-Dade State Attorney’s Office spokesperson said: “We are presently reviewing the court order to determine whether we will be appealing this decision.”

Law enforcement has struggled to figure out how Bitcoin fits into illegal activities, and Espinoza’s case was believed to be the first money-laundering prosecution involving the virtual currency.

Posted by Paul Hamilton

Sources for this article are:

http://www.fatf-gafi.org/publications/fatfgeneral/documents/guidance-rba-virtual-currencies.html

http://www.miamiherald.com/news/local/crime/article91682102.html#storylink=cpy

http://www.forbes.com/sites/kellyphillipserb/2016/07/27/miami-judge-rules-that-bitcoin-is-not-money/#4e41aaec12e9

by Admin | Anti-money laundering

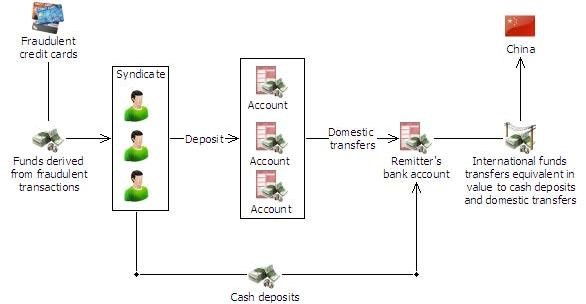

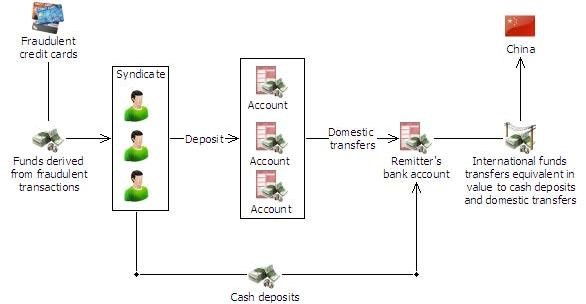

A suspicious matter report (SMR) was the catalyst for a law enforcement operation which resulted in the arrest of three foreign nationals. The operation revealed a multi-million dollar money laundering syndicate which was laundering illicit proceeds derived from producing fraudulent credit cards.

As a result of the SMR referral authorities seized more than 10,000 fake credit cards, which they believed had the potential to fund AUD25 million worth of fraudulent transactions.

The initial SMR related to the main suspect making an outgoing international funds transfer instruction (IFTI) to China, funded with AUD500,000 in cash from an unknown source. Two foreign nationals were also recruited by the main suspect to conduct similar financial transactions for the syndicate.

The lodgement of the SMR triggered AUSTRAC’s automated monitoring systems and initiated enquiries by AUSTRAC of related financial transactions. The enquiries revealed that the syndicate used remitters who primarily sent funds to Chinese beneficiaries and also identified other high-value transactions made by the main suspect. The other transactions included cash deposits of values more than AUD10,000 that was reported to AUSTRAC via threshold transaction reports (TTRs).

Over a two-week period, the main suspect deposited cash into the remitter’s account, totalling AUD1.75 million, which funded international funds transfers to two beneficiaries in China. The suspect also made a foreign exchange purchase of AUD300,000, meaning that, over a two-week period, the main suspect had exchanged or deposited more than AUD2 million cash.

A further seven SMRs were submitted to AUSTRAC from reporting entities over the next four months, detailing further transactions worth AUD2 million, including cash deposits and IFTIs.

The SMRs identified that the syndicate was:

- depositing large values of cash into the account of a remittance business to fund IFTIs which were sent immediately after the deposit

- conducting multiple domestic transfers from several bank accounts into the same remitter’s bank account, to fund IFTIs equal in value to the domestic transfers.

AUSTRAC assisted authorities with further searches on related financial transaction reports and found that the syndicate had, over this same four-month period, deposited more than AUD5 million in cash and conducted AUD6.5 million worth of outgoing international funds transfers to China and Hong Kong.

Authorities arrested the main suspect and two other foreign nationals and seized fraudulent credit cards, sophisticated card-making equipment and AUD60,000 cash.

Two of the syndicate members pleaded guilty to dealing with cash reasonably suspected of being the proceeds of crime and were sentenced to seven months and 12 months imprisonment. The main suspect was charged with offences relating to the manufacture of counterfeit credit cards, possessing proceeds of crime, money laundering offences and having a false passport. The suspect was sentenced to a maximum of five years and nine months.

| Offence |

Fraud |

|

Money laundering |

| Customer |

Individual |

| Industry |

Banking (ADIs) |

|

Remittance services |

| Channel |

Physical |

|

Electronic |

| Report type |

IFTI |

|

SMR |

|

TTR |

| Jurisdiction |

Domestic |

|

International – China, Hong Kong |

| Designated |

Account and deposit-taking services |

| service |

Remittance services (money transfers) |

|

| Indicators |

Financial transactions inconsistent with established profile |

|

Frequent and large-value cash deposits into a remitter’s bank account to fund an |

|

international funds transfer |

|

Multiple domestic transfers, from several accounts, into a remitter’s bank account to fund |

|

an international funds transfer |

|

Unexplained wealth |

This article is the copyrighted work of AUSTRAC. You may download, display, print and reproduce this material in unaltered form only (retaining this notice) for your personal, non-commercial use or use within your organisation. Where material has been sourced from other third-party sources, copyright continues.

by Admin | Anti-money laundering

On 5 July 2016, the European Commission (the “Commission”), adopted proposals to further reinforce EU rules on anti-money laundering, counter terrorist financing and increase transparency of ownership for both companies and trusts. According to the Commission, this proposal is the first initiative to implement the Action Plan for strengthening the fight against terrorist financing.

With regard to countering terrorism financing, the Action Plan highlights the following points:

- EU Financial Intelligence Units will have increased powers:Financial Intelligence Units will have swift access to information in centralized bank and payment account registers and central data retrieval systems, which Member States will have to establish to identify holders of bank and payment accounts

- Tackling terrorist financing risks linked to virtual currencies:Virtual currency exchange platforms, custodian wallet providers will be under the scope of the Anti-Money Laundering Directive, ending the anonymity associated with such exchanges

- Tackling risks linked to anonymous pre-paid instruments (e.g. pre-paid cards): Lowering the thresholds for identification from €250 to €150 on pre-paid cards, and widening customer verification requirements to minimize their use as anonymous payments vehicle

- Stronger checks on risky third countries:In line with the Risk-Based Approach banks will have to carry out additional checks (‘enhanced due diligence measures’) on financial flows from countries with deficiencies in their anti-money laundering and countering terrorist financing regimes.

The Action Plan also proposes stricter transparency rules to prevent tax avoidance and money laundering, which highlights:

- Full public access to the beneficial ownership registers:Member States will make public certain information of the beneficial ownership registers on companies and business-related trusts. The threshold on beneficial owners is 10% for companies that present a risk of being used for money laundering and tax evasion for all other companies the threshold remains at 25%.

- Interconnection of the registers: The direct interconnection of the registers to facilitate cooperation between Member States.

Extending the information available to authorities: The Panama Papers highlighted areas where further enhancements would be advisable. Existing, as well as new, accounts should be subject to due diligence controls. This will prevent accounts that are potentially used for illicit activities or avoiding taxation from escaping detection.

The Action Plan could also have an impact on the transposition of the Fourth AMLD by Member States. 26 June 2017 is the formal transposition date for the fourth AMLD. In an effort to strengthen the fight against terrorism financing of 2 February 2016, the Commission called on Member States to move the effective transposition date of the directive forward to the end of 2016.

Content for this blog can be found at the following links:

http://europa.eu/rapid/press-release_IP-16-2380_en.htm

http://europa.eu/rapid/press-release_MEMO-16-2381_en.htm

Posted by Paul Hamilton

by Admin | Anti-money laundering

“In the wake of the Panama Papers controversy, the U.S. government has taken major steps this month to promote financial transparency. First, the Financial Crimes Enforcement Network (FinCEN) finalized its proposed rule issued in July 2014 (see client alert, “FinCEN Proposes Tighter Customer Due Diligence Requirements for Financial Institutions”), requiring banks and other covered financial institutions to identify and verify the identity of beneficial owners behind legal entity customers. The final rule also added a new “fifth pillar” to the anti-money laundering (AML) program rules, which requires appropriate risk-based procedures for conducting ongoing customer due diligence (CDD). Covered financial institutions will have to comply with these new requirements by May 11, 2018 (the Applicability Date).

Second, the Treasury Department proposed legislation that, if enacted, would require all companies formed in the United States to report beneficial ownership information to the Treasury Department.

Finally, the Justice Department submitted to Congress a legislative proposal that would enhance the ability of law enforcement officials to obtain information from domestic and foreign banks so they can investigate and prosecute money laundering. The legislation also would allow the Justice Department to prosecute money laundering linked to a broader set of predicate crimes. These regulatory changes and legislative proposals send a clear message to financial institutions in the United States and around the globe: The U.S. government is taking a tougher stance against money laundering and corruption. Thus, we expect enforcement actions to rise.

Financial institutions should consider the following key takeaways:

FinCEN’s Model Certification Form Will Not Be Required and Will Not Trigger a Safe Harbor. FinCEN dropped its proposal to mandate the use of its model Certification Form to collect beneficial ownership information from customers. Financial institutions will be able to obtain the required information by any means they deem appropriate, such as by using an institution’s proprietary form or directly capturing the relevant data in a customer database. Whichever method is employed, however, the individual opening the account on behalf of the legal entity customer must certify, to the best of his or her knowledge, the accuracy of the information. This change from the proposed rule will reduce the technological and operational changes that institutions must implement to comply with the rule. For example, institutions that already collect beneficial ownership information may continue to obtain and retain this data in the form (paper or electronic) that they have been using, as long as they satisfy the rule’s other requirements. FinCEN also declined to create a safe harbor for those that opt to use the Certification Form.

Institutions Will Be Required to Identify At Least One and as Many as Five Beneficial Owners for Each New Account Opened by a Legal Entity Customer. The rule defines a beneficial owner as each individual, if any, who directly or indirectly owns 25 percent or more of the equity interests of a legal entity customer (the ownership prong) and a single individual with significant responsibility to control, manage or direct a legal entity customer (e.g., chief executive officer, chief financial officer, chief operating officer, managing member, president, vice president) (the control prong). As a practical matter, this means that a financial institution will have to identify one beneficial owner under the control prong, regardless of whether any individual meets the 25 percent threshold. Moreover, institutions will be obligated to collect the required beneficial ownership information every time a new account is opened, even if the customer has other existing accounts for which the institution already obtained such information. Notwithstanding FinCEN’s requirements, financial institutions will have the discretion to identify additional beneficial owners or to establish a lower percentage threshold for beneficial ownership based on their own risk assessment. Accordingly, financial institutions will want to consider clear procedures outlining the circumstances in which more stringent requirements regarding beneficial ownership are warranted.

Reliance on Representations of Customers Will Be Permitted, Absent the Institution’s Knowledge to the Contrary. Financial institutions may rely on the information supplied by a legal entity customer regarding the identity of its beneficial owners, provided that the institution has no knowledge of facts that would reasonably call into question the reliability of such information. In other words, an institution cannot turn a blind eye to apparent red flags that it discovers through its onboarding or monitoring processes. A corollary to this provision is that while institutions need to verify the identity of beneficial owners (i.e., the individual’s existence), they are not required by the rule to engage in analyses or research to determine whether an individual is, in fact, a beneficial owner. Although FinCEN has recognized that the burden to identify beneficial ownership will largely lie on the legal entity customer and not on the institution, over-reliance on a customer’s representations should be avoided. Institutions will want to consider implementing risk-based policies to assess the reliability of information provided by their legal entity customers.

Although the Final Rule Only Applies Prospectively, Institutions Should Consider Collecting Beneficial Ownership Information for Existing Accounts on a Risk-Basis. Financial institutions will not be categorically required to gather beneficial ownership information for accounts established before the Applicability Date. In other words, the rule will only apply to accounts opened on or after such date. However, FinCEN has stated that it expects financial institutions to obtain beneficial ownership information for pre-existing accounts, when in the course of their normal monitoring, institutions detect information relevant to assessing or reevaluating an account’s risk. Such information could include, for example, a significant and unexplained change in customer activity. Although FinCEN only expects monitoring-triggered updates of beneficial ownership information, institutions should consider taking advantage of CDD refreshers to collect or update, on a risk-basis, beneficial ownership information for both pre-existing and new accounts. The risk-mitigating benefits of adopting this practice would far outweigh the associated costs.

FinCEN’s ‘Fifth’ AML Pillar Codifies Existing Obligations. FinCEN’s new “fifth” pillar will require all covered financial institutions to (i) understand the nature and purpose of customer relationships for the purpose of developing a customer risk profile; and (ii) conduct ongoing monitoring to identify and report suspicious transactions and, on a risk-basis, maintain and update customer information. In the past, these two elements were implicitly required in connection with an institution’s suspicious activity reporting obligations. Institutions will want to consider updating their policies to reflect these requirements explicitly, if that is not yet the case, and ensuring that their existing processes are designed to satisfy these obligations.

US Authorities Likely Will Increase Their Focus on AML and Sanctions Enforcement. We anticipate that the new beneficial ownership requirements will raise U.S. regulators’ expectations with respect to how an institution leverages its CDD procedures to comply with applicable AML and sanctions laws and regulations. In its final rule, FinCEN underscored that beneficial ownership information should be treated like a customer identification program and accordingly used to ensure that covered financial institutions comply with other rules. For example, FinCEN pointed out that institutions should use beneficial ownership information to ensure compliance with sanctions administered by the Office of Foreign Assets Control (OFAC) and specifically referenced OFAC’s 50 percent rule. In addition, with respect to aggregation of transactions for currency transaction reporting purposes, FinCEN noted that beneficial ownership identification may provide institutions with information they did not previously have, in order to determine when transactions are “by or on behalf of” the same person. We, therefore, expect that this final rule and the increased focus on financial transparency in the United States and abroad will result in increased enforcement and will make mitigation arguments more difficult in the event of a violation.

Assessing Existing CDD Procedures and Overall AML/Sanctions Programs. Although compliance with the final rule will not be required for two years, we anticipate that examiners will increasingly focus on this issue in AML target examinations and, in particular, will seek to understand how a financial institution is preparing to comply with the rule.

As such, financial institutions will want to consider examining their current AML/sanctions programs and creating an action plan detailing how they will adapt various aspects of their programs to the new rule, including CDD policies and procedures, employee training, monitoring systems, suspicious activity reporting and other relevant processes. Institutions that already collect beneficial ownership information should consider reassessing their existing compliance frameworks.

Managing Differences Between US and EU CDD Requirements. Since 2005, the EU has required financial institutions and other covered entities to collect beneficial ownership information. The Fourth AML Directive, which was enacted last year and which member states have to comply with by June 2017, also will further tighten existing rules. In particular, member states will have to establish central registers of beneficial owners that will be accessible to financial institutions and other designated parties. Member states also will have the authority to set lower beneficial ownership thresholds than the currently mandated threshold of an interest exceeding 25 percent. The EU’s CDD requirements differ in certain respects from FinCEN’s final rule. The latter provides more specificity in its requirements, whereas the former is predominantly focused on a risk-based approach. For instance, although both use “ownership” and “control” thresholds to define beneficial owners, FinCEN’s rule requires that only one individual be identified under the “control” threshold while the fourth directive does not specify how many need to be identified. Presumably, multiple individuals may exercise control over a legal entity, which means that a financial institution in the EU may have to identify more than one individual under the “control” threshold in accordance with the institution’s assessment of risk. The fourth directive also does not specifically provide for reasonable reliance on representations made by customers regarding their beneficial owners. This could suggest that EU regulators may expect financial institutions to conduct appropriate risk-based due diligence to independently vet the reliability of the information provided by a customer. In sum, institutions with global compliance programs will want to manage the differences between U.S. and EU CDD requirements, especially if their approach is to implement the strictest requirements of the jurisdictions in which they operate”.

The “FinCEN Finalizes Customer Due Diligence Rule Amid Other Actions to Enhance Financial Transparency” was uploaded and shared by Paul Hamilton.

This article and the author can be viewed at https://www.skadden.com/insights/fincen-finalizes-customer-due-diligence-rule-amid-other-actions-enhance-financial-transparency